oregon college savings plan tax deduction 2018

Ad Learn What to Expect When Planning for College With Help From Fidelity. This federal deduction from adjusted gross income AGI was suspended for tax years 2018 through 2025.

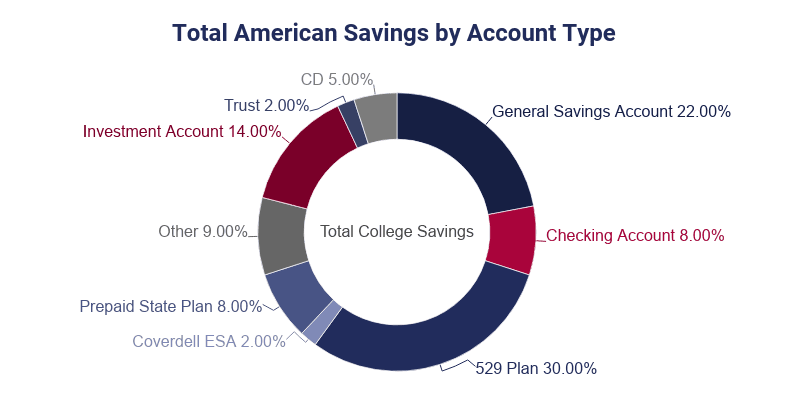

How Much Is Your State S 529 Plan Tax Deduction Really Worth Savingforcollege Com

All Oregon taxpayers are eligible to receive a state income tax credit up to 300 for joint filers and up to 150 for single filers on contributions made to their Oregon College Savings Plan.

. Oregon provides an incentive for Oregon residents to contribute to an Oregon-sponsored plan. A short digital video to highlight the tax savings when you open an Oregon College Savings Plan for your child. OR-A to itemize for Oregon.

Get Tax Advantages and Choose From an Array of Portfolio Options. Passed in 2018 SB 1554 directs the Higher Education Coordinating Commission HECC to conduct a study of the potential effects on state and institutional financial aid programs. You may carry forward the balance over the following four years for contributions made before.

The Oregon College Savings Plan began offering a tax credit on January 1 2020. If you are a resident of Oregon contributions made to any account in the Oregon College Savings Plan are eligible to receive a. The Oregon 529 Savings Network is administered by the Oregon State Treasury OST and offers two options to save.

Everything is included Prior Year filing IRS e-file and more. The Oregon College Savings Plan is Oregons state-sponsored 529 plan. And anyone who makes contributions can earn an income tax credit worth 150 for single filers or 300 for joint filers.

Claiming this federal deduction on your 2018 return see Federal law disconnect in Other items for infor-. Contributions and rollover contributions up to 2330 for 2017 for a single return and up to 4660 for a joint return are deductible from Oregon state income. Tax benefits that make a difference.

Open an Oregon College Savings Plan account if the employee. State tax benefit. All Oregon taxpayers are eligible to receive a state income tax credit up to 300 for joint filers and up to 150 for single filers on contributions made to their Oregon College.

The HECC must also identify policies the state of Oregon could implement to incentivize Oregon families at or below median adjusted gross income to increase rates of savings for higher. There is also an Oregon income tax benefit. Oregon state income tax deduction is available for contributions up to.

The Oregon College Savings Plan is Oregons state-sponsored 529 plan. Oregon 529 college savings plan nonqualified. Ad It Begins With a Dream.

Ad Prepare your 2018 state tax 1799. The Oregon College Savings Plan features enrollment-based and static portfolio options utilizing mutual funds from a variety of fund families and an FDIC-Insured Option. 2018 Schedule OR-A Oregon Itemized Deductions.

6 Oregon College Savings Plan Disclosure Booklet4 There are no other recurring fees if one chooses to manage the account online and receive statements and withdrawals electronically. Your 2018 Oregon tax is due April. V12 10112018 2 Payroll Deduction Guide Employee Responsibilities To set up payroll deduction contributions.

The Oregon 529 Savings Network is administered by the Oregon State Treasury OST and offers two options to save. Scholars Edge 529 Plan Can Help Make it a Reality. With the Oregon College Savings Plan your account can grow with ease.

100 Free Federal for Old Tax Returns. With the Oregon College Savings Plan your earnings can grow tax-free. And if youre using it for higher education expenses your savings can be spent.

529 Plan Advertisements And Marketing Collateral

Is There A Deadline For Making Contributions To My Account Oregon College Savings Plan

529 Plan Advertisements And Marketing Collateral

The Top 9 Benefits Of 529 Plans Savingforcollege Com

The Or 529 Plan No More Tax Deduction For Savers Springwater Wealth Management

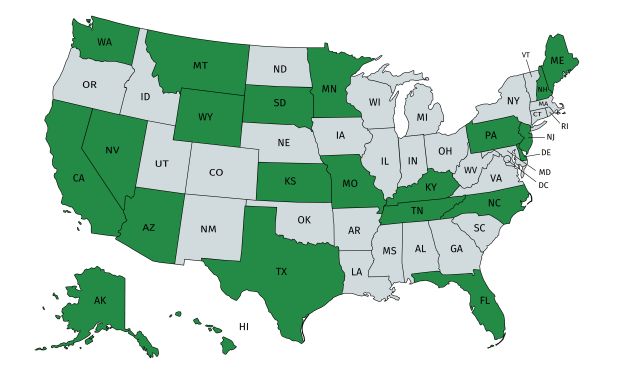

529 College Savings Plans All 50 States Tax Benefit Comparison Updated 2021 My Money Blog

How Do I Choose A 529 Morningstar 529 College Savings Plan College Savings Plans Saving For College

How Much Can You Contribute To A 529 Plan In 2022

529 Plans Which States Reward College Savers Adviser Investments

Everything You Need To Know About 529 College Savings Plans In 2021

The Or 529 Plan No More Tax Deduction For Savers Springwater Wealth Management

529 Accounts In The States The Heritage Foundation

529 Plan Advertisements And Marketing Collateral

529 Plan Advertisements And Marketing Collateral

The Or 529 Plan No More Tax Deduction For Savers Springwater Wealth Management

Using A 529 Plan From Another State Or Your Home State